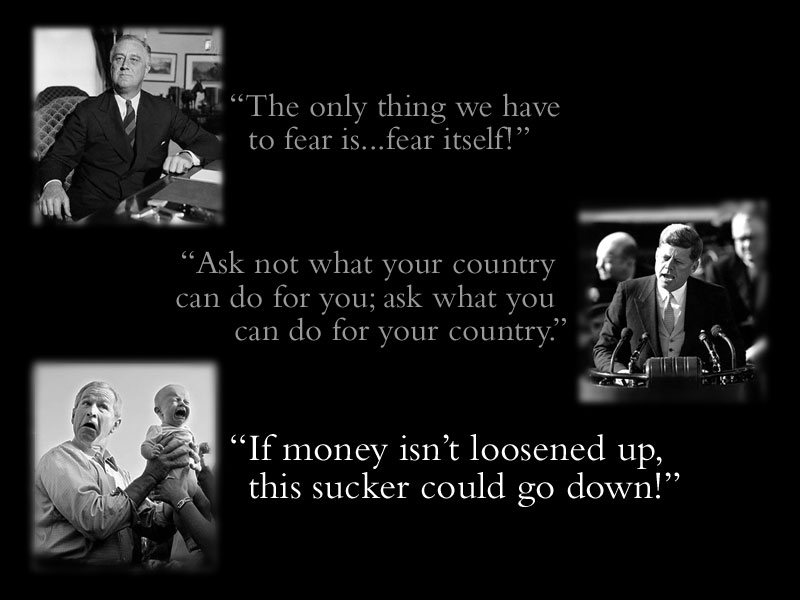

So, we’re supposed to trust Hank Pauslon with $700,000,000,000 because he’s a smart guy, right? I mean, as the former head of Goldman Sachs, with a net personal worth of over $700,000,000, he can certainly handle these big sums!

But… I wonder… isn’t this the same Hank Paulson who helped get us into this mess? The same Hank Paulson who’s been declaring all through the spring that “our economy is sound” and that we’ve “reached the bottom of the housing market?” He was the head of the Investment Banking unit at Goldman before he became the chief executive!

He knows exactly what he’s doing: bailing out his buddies and partners from the mess they themselves created, with OUR money.

How about asking an actual expert, one who wasn’t compensated to the tune of $30,000,000 per year by the very company he’s now proposing, as a “public servant,” to “help” with taxpayer funds?

Nourel Roubini – unlike Hank Paulson, Ben Bernanke, George Bush, Nancy Pelosi, Chris Dodd, Barney Frank, John McCain, or Barack Obama – has been accurately predicting the contours of our current financial crisis going back several years. In February, he predicted that a major US investment bank would collapse; after Bear Stearns went down, he predicted that there would be no independent investment banks in the US (and this has already come to pass). He’s been right as often as Paulson, Bernanke, et al. have been wrong.

Here’s what Dr. Roubini has to say about the “bailout” plan that went down to defeat in the House today:

Thus the claim by the Fed and Treasury that spending $700 billion of public money is the best way to recapitalize banks has absolutely no factual basis or justification. This way of recapitalizing financial institutions is a total rip-off that will mostly benefit – at a huge expense for the US taxpayer – the common and preferred shareholders and even unsecured creditors of the banks. Even the late addition of some warrants that the government will get in exchange of this massive injection of public money is only a cosmetic fig leaf of dubious value as the form and size of such warrants is totally vague and fuzzy.

So this rescue plan is a huge and massive bailout of the shareholders and the unsecured creditors of the financial firms (not just banks but also other non bank financial institutions); with $700 billion of taxpayer money the pockets of reckless bankers and investors have been made fatter under the fake argument that bailing out Wall Street was necessary to rescue Main Street from a severe recession. Instead, the restoration of the financial health of distressed financial firms could have been achieved with a cheaper and better use of public money.

It’s worth reading his other essays, wherein he lays out, in great detail, exactly what sort of plan he believes would most benefit the US and the world economy at large. He relies for support not just on his gut instinct, or on what his golfing buddies told him, but on actual historical data from more than thirty other credit crisis in large economies over the last fifty years. He shows that the course currently being proposed by the wonder twins of Bernanke and Paulson is, in fact, the most expensive and least likely to achieve its stated aims.

It will, however, line the pockets of Goldman Hank’s buddies on Wall Street, and it will ensure that the Federal treasury is completely empty, so that – regardless of what he’s ready to do on Day One – the next President will find himself searching in vain for a dollar to spend.

Maybe that’s why Barack Obama keeps asking for “change”!

Do you also want to write a nice papers? Use help of Speedy Paper!