Posted on June 21st, 2011 at 1:24 pm by Steve

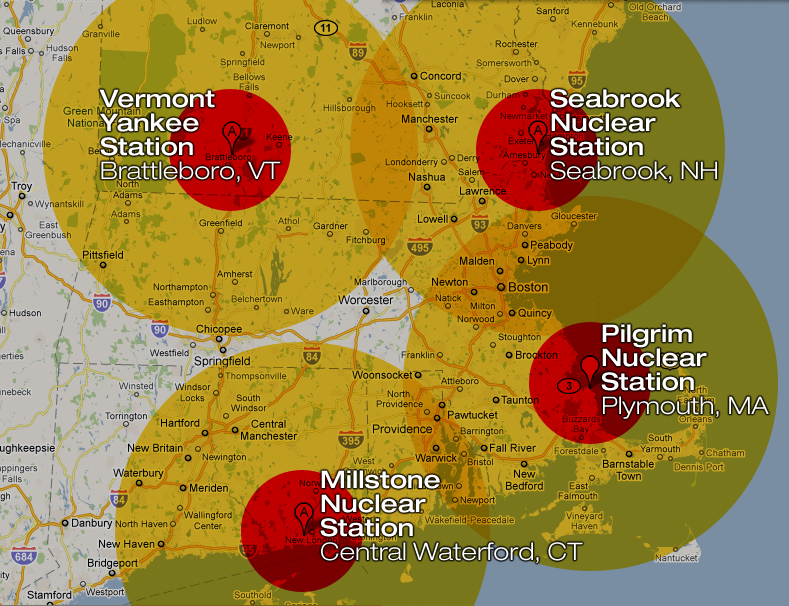

So, rising floodwaters in Nebraska have completely surrounded two nuclear power plants. But, hey, don’t worry! The plant at Fort Calhoun Station (a full 19 miles from Omaha – stay put, Warren Buffet!) has been in “cold shutdown” since April. The plant’s managers decided not to restart the nuclear chain reaction, given the impending floods.

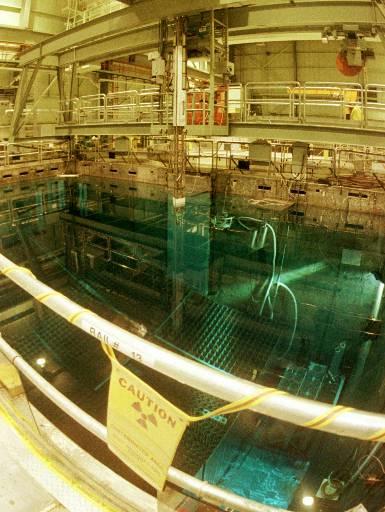

Of course, they did have a “small fire” that…well, actually, it only knocked out the cooling water pumps in the “spent fuel” storage pool for 90 minutes, during which time the temperature in the pool rose “a few degrees.” But, hey, at that rate of temperature increase, it would’ve taken days (well, 88 hours) for the water in the pool to start boiling away. What happens then? The fuel melts… it oxidizes… it can catch fire and spread radioactive materials over a large area.

But, don’t panic! How could a nuclear plant possibly lose all of its power? I mean, they have grid power and backup generators, right? How could the grid connection fail? (Certainly not due to a massive regional flood!) How could the diesel generators fail? (Certainly not due to being submerged by the aforementioned flood!) After all, the operators of Fort Calhoun have planned ahead! They installed a giant rubber innertube around the plant to hold back the waters:

[Plant spokesman] Gates said an Aqua Dam currently protects the switchyard and substation at Fort Calhoun, tall enough to withstand floodwaters at a 1,010 elevation (the river level is currently at an elevation of 1,005 feet, 7 inches).

[Source: OPPD: Nuclear station “safe and will continue to be safe”, The Washington County Pilot-Tribune and Enterprise, June 17, 2011]

How could the river rise another four feet, five inches? I mean, it’s not like the levees and dams upstream are stressed and starting to breach? It’s not like it might rain any more than it already has…

Perhaps the most significant impact of the [June 20] storm was the large area of 1 – 4 inches of rain it dropped on Nebraska and South Dakota. This rain will run off into the Missouri River, further aggravating the flooding that has breached two levees and overtopped two other levees in the past week. The large, slow-moving low pressure system responsible for the rains and severe weather will bring additional heavy rains of 1 – 3 inches over portions of the Missouri River watershed today [June 21], and will touch off a new round of severe weather today and Wednesday as the storm progresses slowly eastwards.

[Source: Jeff Masters, Ph.D., founder and chief meteorologist of the Weather Underground, Inc.]

Well, the good thing is that nuclear plants in the United States are designed with extremely conservative assumptions, so there’s a very high margin of safety! Oh, and also… even for plants that were built 37 years ago, like the Cooper Nuclear Station, just downstream from Fort Calhoun (and also inundated with floodwaters), they’re subject to constant inspections and tough regulations!

Failed cables. Busted seals. Broken nozzles, clogged screens, cracked concrete, dented containers, corroded metals and rusty underground pipes — all of these and thousands of other problems linked to aging were uncovered in the AP’s yearlong investigation. And all of them could escalate dangers in the event of an accident.

Yet despite the many problems linked to aging, not a single official body in government or industry has studied the overall frequency and potential impact on safety of such breakdowns in recent years, even as the NRC has extended the licenses of dozens of reactors.

[…]

Records show a recurring pattern: Reactor parts or systems fall out of compliance with the rules. Studies are conducted by the industry and government, and all agree that existing standards are “unnecessarily conservative.”

Regulations are loosened, and the reactors are back in compliance.

[Source: “U.S. nuke regulators weaken safety rules,” by the Associated Press, June 20, 2011]

As Harry Shearer says, “Safe! Clean! Too cheap to meter! Our friend, the atom.”