Canada to Sell, Buy, “Non-Self-Sustaining” Companies

Posted on June 2nd, 2009 at 10:26 am by Steve

See if you can discern the principle at work in these two news reports below.

First, from yesterdays’ National Post:

The [Canadian] federal Department of Finance has flagged several prominent Crown corporations as “not self-sustaining,” including the CBC, VIA Rail and the National Arts Centre, and has identified them as entities that could be sold as part of the government’s asset review, newly released documents show.

Second, from today’s Globe and Mail:

The [Canadian] federal and Ontario governments are receiving 12 per cent of the common shares in the new GM in return for $10.6-billion (Canadian) in financial assistance. The governments also receive about $1.3-billion in debt and some preferred shares in the new company.

But Prime Minister Stephen Harper held out almost no hope Monday that the bulk of the money will be repaid.

“Clearly, taxpayers will get some money back when the day comes that we begin to sell our equity share, but to be frank, we are not counting on that,” Mr. Harper told reporters. “We are not factoring that into our budgetary plans.”

I’m certainly not a mind-reader, but if I had to guess, here’s what I’d propose as the operative principle: “We will give taxpayers’ money to wealthy industrialists, shareholders, and friends, with little promise of return. We will NOT give taxpayers’ money to any organization which fails to benefit those same wealthy industrialists, shareholders, and friends…even if that organization actually provides valuable public services.”

What’s your guess?

Talk About “Toxic” Assets!

Posted on April 16th, 2009 at 11:03 am by Steve

According to Andrew Clark in the Guardian,

The rump of the bankrupt bank Lehman Brothers is sitting on a stockpile of 450,000 lb of uranium “yellowcake” which could be used to power a nuclear reactor or, theoretically, to make a bomb.

Those are some seriously toxic assets!

Remember when yellowcake was such a big deal that the U.S. government used it as justification to invade and destroy Iraq? Here are those famous sixteen words again, in case you’ve forgotten Bush’s fabulous 2003 State of the Union speech:

The British government has learned that Saddam Hussein recently sought significant quantities of uranium from Africa.

So, maybe the U.S. will be invading Lehman Brothers next…?

What Could Possibly Go Wrong?

Posted on March 6th, 2009 at 11:59 am by Steve

Today’s Washington Post describes the Treasury Department’s latest plan:

The government is seeking to resuscitate the nation’s crippled financial system by forging an alliance with the very outfits that most benefited from the bonanza preceding the collapse of the credit markets: hedge funds and private-equity firms.

The initiative to revive the consumer lending business, outlined by officials this week, offers these wealthy investors a new chance to make sizable profits — but, thanks to the government, without the risk of massive losses.

That would be like the government guaranteeing the mortgages of all the homeowners who are “underwater,” but letting the homeowners keep all the profits if their homes rise in value and they’re able to sell at a profit. Something tells me that wouldn’t fly. As Atrios says,

They made bad bets when they at least theoretically thought they could incur losses. Now the cunning plan is to hope they make good bets even though…no chance of losses!

This is all going to end really badly.

Cats and Dogs: Iceland’s Economic Miracle

Posted on March 3rd, 2009 at 4:58 pm by Steve

A great Vanity Fair article explains Iceland’s economic crash:

Yet another hedge-fund manager explained Icelandic banking to me this way: You have a dog, and I have a cat. We agree that they are each worth a billion dollars. You sell me the dog for a billion, and I sell you the cat for a billion. Now we are no longer pet owners, but Icelandic banks, with a billion dollars in new assets. “They created fake capital by trading assets amongst themselves at inflated values,” says a London hedge-fund manager. “This was how the banks and investment companies grew and grew. But they were lightweights in the international markets.”

How To Raise Taxes Without Losing Votes

Posted on January 24th, 2009 at 12:40 am by Steve

Governor Deval Patrick said today that he was interested in placing tolls on vehicles on interstate highways at the state’s borders and that his administration had already contacted the federal government, which would need to give its permission, about the idea.

“What I would love to see is … border tolls at all of the interstate entrances, maybe Route 3 as well. In other words, Vermont, New Hampshire, Rhode Island, Connecticut, New York. If we did that right, it would be possible to remove all of the tolls inside of the Commonwealth.”

Patrick rediscovers a timeless political solution: Raise the taxes paid by people who can’t vote against you!

Your Financial Future

Posted on November 20th, 2008 at 3:31 pm by dr.hoo

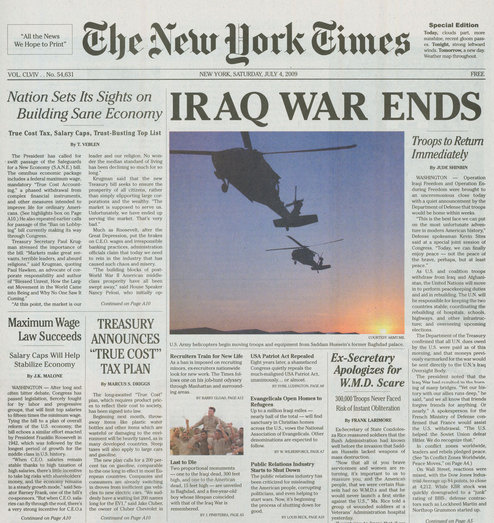

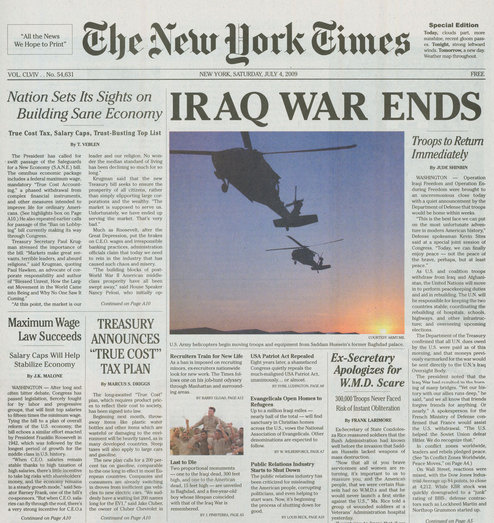

Best NYT Front Page EVER!

Posted on November 13th, 2008 at 1:21 pm by Steve

IRAQ WAR ENDS and other great headlines in today’s (fake) New York Times (courtesy of The Yes Men).

Posted in art, community, corporations, design, economy, energy, finance, funny, future, government, local, media, military, odd, peace, political, pure geekery, roflmao, tech, war | 1 Comment »

The Cost of War = $3 Trillion

Posted on November 11th, 2008 at 2:58 pm by dr.hoo

Who Has a Place at the Policy-Making Table?

Posted on November 7th, 2008 at 12:50 pm by Steve

Let me preface this post by explaining my reason for posting it. It is not to condemn Obama, or to criticize those of us who voted for him (as, in fact, I did). It is to remind us that the real work of influencing policy decisions is ongoing, and to shine a bright light on the choices that Obama and his advisers are making. I am heartened by the fact that Obama is intelligent, reasonable, educated, and engaged with the world – indeed, it is for those very reasons that I believe he may be amenable to progressive influences. But we must be those influences.

Let me preface this post by explaining my reason for posting it. It is not to condemn Obama, or to criticize those of us who voted for him (as, in fact, I did). It is to remind us that the real work of influencing policy decisions is ongoing, and to shine a bright light on the choices that Obama and his advisers are making. I am heartened by the fact that Obama is intelligent, reasonable, educated, and engaged with the world – indeed, it is for those very reasons that I believe he may be amenable to progressive influences. But we must be those influences.

So… the Obama team announced the formation of their Transition Economic Advisory Board:

The Transition Economic Advisory Board will help guide the work of the Obama-Biden transition team in developing a strong set of policies to respond to the economic crisis. The Board includes:

- David Bonior (Member House of Representatives 1977-2003)

- Warren Buffett (Chairman and CEO, Berkshire Hathaway)-will participate via speakerphone

- Roel Campos (former SEC Commissioner)

- William Daley (Chairman of the Midwest, JP Morgan Chase; Former Secretary, U.S. Dept of Commerce, 1997-2000)

- William Donaldson (Former Chairman of the SEC 2003-2005)

- Roger Ferguson (President and CEO, TIAA-CREF and former Vice Chairman of the Board of Governors of the Federal Reserve)

- Jennifer Granholm (Governor, State of Michigan)

- Anne Mulcahy (Chairman and CEO, Xerox)

- Richard Parsons (Chairman of the Board, Time Warner)

- Penny Pritzker (CEO, Classic Residence by Hyatt)

- Robert Reich (University of California, Berkeley; Former Secretary, U.S. Dept of Labor, 1993-1997)

- Robert Rubin (Chairman and Director of the Executive Committee, Citigroup; Former Secretary, U.S. Dept of Treasury, 1995-1999)

- Eric Schmidt (Chairman and CEO, Google)

- Lawrence Summers (Harvard University; Managing Director, D.E. Shaw; Former Secretary, U.S. Dept of Treasury, 1999-2001)

- Laura Tyson (Haas School of Business, University of California, Berkeley; Former Chairman, National Economic Council, 1995-1996; Former Chairman, President’s Council of Economic Advisors, 1993-1995)

- Antonio Villaraigosa (Mayor, City of Los Angeles)

- Paul Volcker (Former Chairman, U.S. Federal Reserve 1979-1987)

Let’s review: 17 members. Eight captains of finance and industry, including three former federal officials. Seven more former federal government officials. One governor of a midwestern state. One mayor of a large city. No representatives of labor unions. No representatives of non-governmental, non-financial entities. No academics without deep ties to the federal government. No one to represent the voices of the poor, the marginalized, the disenfranchised.

And now recall the Chomsky excerpt, posted below:

The domestic sources of power remain basically unchanged, whatever the electoral outcome. The major decision-making positions in the executive branch of the government, which increasingly dominates domestic and foreign policy, remain overwhelmingly in the hands of representatives of major corporations and the few law firms that cater primarily to corporate interests… It is hardly surprising, then, that the basic function of the State remains the regulation of domestic and international affairs in the interest of the masters of the private economy, a fact studiously ignored in the press and academic scholarship, but apparent on investigation of the actual design and execution of policy over many years.

We’ve got our work cut out for us.

Chomsky: Myth and Reality

Posted on November 6th, 2008 at 10:39 pm by Steve

Radical Priorities, Pages 119-120:

In attempting to assess a new Administration in the United States, it is important to bear in mind the extraordinarily narrow spectrum of political discourse and the limited base of political power, a fact that distinguishes the United States from many other industrial democracies. The United States is unique in that there is no organized force committed to even mild and reformist varieties of socialism. The two political parties, which some refer to, not inaccurately, as the two factions of the single ‘Property Party,’ are united in their commitment to capitalist ideology and institutions. For most of the period since the Second World War, they have adhered to a ‘bipartisan foreign policy,’ which is to say, a one-party state as far as foreign affairs are concerned. The parties differ on occasion with regard to the role of the State, the Democrats generally tending to favor slight increases in state intervention in social and economic affairs, the Republicans tending to favor greater emphasis on private corporate power. Thus, under a Democratic Administration, there are likely to be some moves toward ‘welfare state’ policies along with a more aggressive foreign policy, as the State pursues a more interventionist program at home and abroad. But these distinctions between ‘liberals’ and ‘conservatives’ are only marginal in their significance and are at most slight tendencies rather than serious alternatives.

The domestic sources of power remain basically unchanged, whatever the electoral outcome. The major decision-making positions in the executive branch of the government, which increasingly dominates domestic and foreign policy, remain overwhelmingly in the hands of representatives of major corporations and the few law firms that cater primarily to corporate interests – thus representing generalized interests of corporate capitalism as distinct from parochial interests of one or another sector of the private economy. It is hardly surprising, then, that the basic function of the State remains the regulation of domestic and international affairs in the interest of the masters of the private economy, a fact studiously ignored in the press and academic scholarship, but apparent on investigation of the actual design and execution of policy over many years.

In fact, if some Administration were to depart in a significant way from the interests of highly concentrated private corporate power, its behavior would quickly be modified by a variety of simple techniques. Basic decisions concerning the health and functioning of the economy – hence social life in general – remain in the private sector. Decisions made in this realm set the conditions and define the framework within which the political process unfolds. By modifying the economic factors under their control, business interests can sharply constrain actions within the political sphere. But the issue rarely arises, since, as noted, the government, including those who manage the state sector of the economy, remains basically in the hands of private capital in any event.

Extra-governmental sources of ideas and programs are also, naturally, dominated by those who control the basic institutions of production, finance, and commerce.

He wrote those words in an article examining the prospects of an incoming Democratic Administration… in 1977.

Let me preface this post by explaining my reason for posting it. It is not to condemn Obama, or to criticize those of us who voted for him (as, in fact, I did). It is to remind us that the real work of influencing policy decisions is ongoing, and to shine a bright light on the choices that Obama and his advisers are making. I am heartened by the fact that Obama is intelligent, reasonable, educated, and engaged with the world – indeed, it is for those very reasons that I believe he may be amenable to progressive influences. But we must be those influences.

Let me preface this post by explaining my reason for posting it. It is not to condemn Obama, or to criticize those of us who voted for him (as, in fact, I did). It is to remind us that the real work of influencing policy decisions is ongoing, and to shine a bright light on the choices that Obama and his advisers are making. I am heartened by the fact that Obama is intelligent, reasonable, educated, and engaged with the world – indeed, it is for those very reasons that I believe he may be amenable to progressive influences. But we must be those influences.